UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| þ | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

| ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| þ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| ||||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| ||||

| (3) | Per unit or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| ||||

| (5) | Total fee paid:

| |||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| ||||

| (3) | Filing Party:

| |||

| ||||

| (4) | Date Filed:

| |||

| ||||

P. H. GLATFELTER COMPANY

96 South George Street, Suite 520

York, Pennsylvania 17401

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON

May 8, 2012MAY 9, 2013

To Our Shareholders:

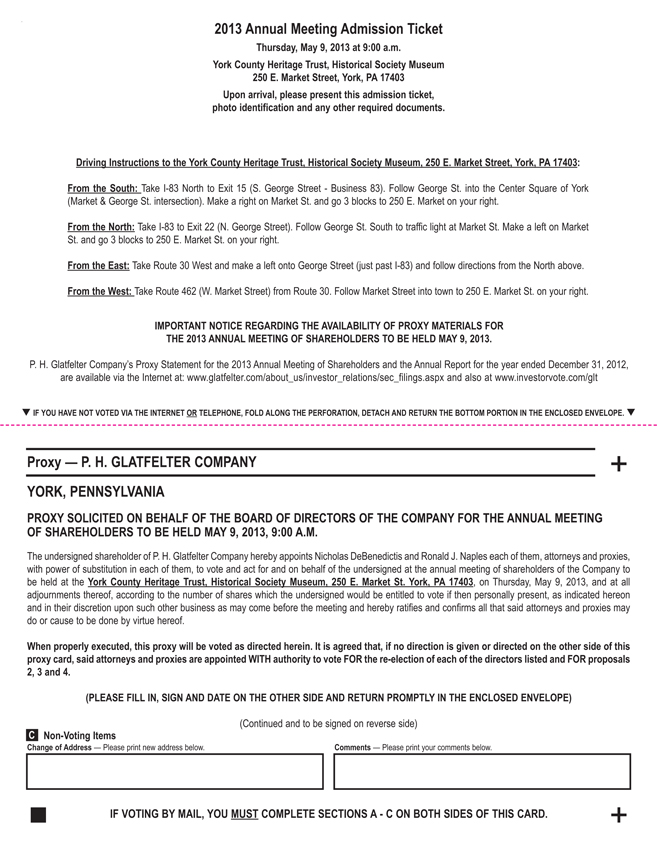

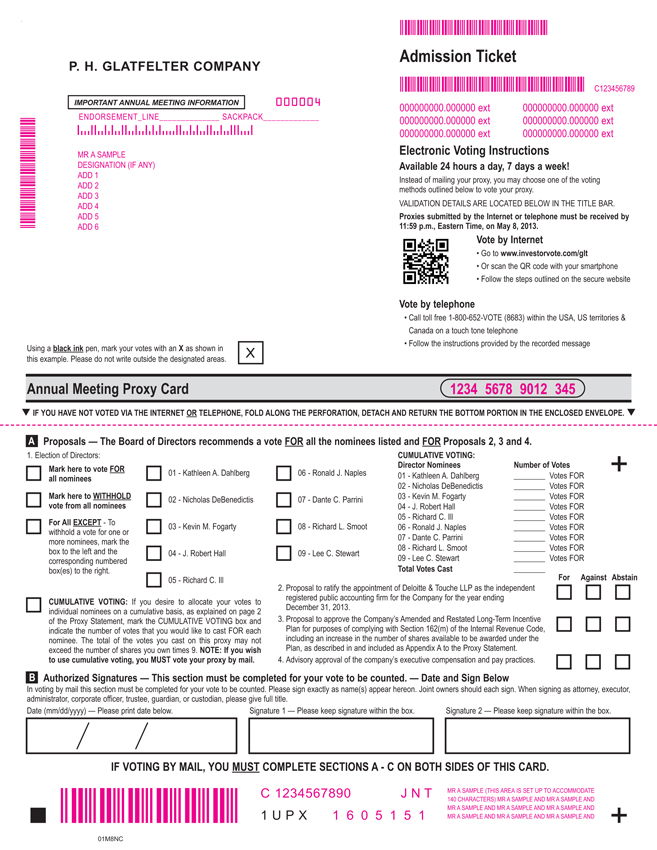

The 20122013 Annual Meeting of the Shareholders of P. H. Glatfelter Company (“Annual Meeting”), a Pennsylvania corporation, will be held at theYork County Heritage Trust, Historical Society Museum, 250 East Market Street, York, Pennsylvania, 17403, on Tuesday,Thursday, May 8, 20129, 2013 at 10:9:00 a. m.a.m., to consider and act upon the following items:

the election of nine (9) members of the Board of Directors to serve until our next Annual Meeting and until their successors are elected and qualified;

a proposal to ratify the appointment of Deloitte & Touche LLP (“Deloitte”) as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2012;2013;

approval of the Company’s Amended and Restated Long-Term Incentive Plan for purposes of complying with Section 162(m) of the Internal Revenue Code, including an increase in the number of shares available to be awarded under the Plan;

advisory approval of the Company’s executive compensation and pay practices; and

such other business as may properly come before the Meeting.

Only holders of record of the Company’s common stock at the close of business on March 9, 201215, 2013 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting.

It is important that your shares be represented and voted at the Annual Meeting. Whether you currently plan to attend the Annual Meeting or not, please vote your proxy by telephone at 1-866-540-5760,1-800-652-VOTE (8683), online athttp://www.proxyvoting.com/gltwww.investorvote.com/GLT, or by completing and signing the enclosed proxy card and returning it promptly in the enclosed envelope (requiring no postage if mailed in the United States). If you choose, you may still vote in person at the Annual Meeting, even if you previously voted by telephone, internet or by mailing a completed proxy card.

Michael L. KorniczkyKent K. Matsumoto

Assistant Secretary

March 29, 2012April 3, 2013

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE 20122013 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY 8, 2012.9, 2013.

P. H. Glatfelter Company’s proxy statement for the 20122013 Annual Meeting of Shareholders and P. H. Glatfelter Company’s 2011its 2012 Annual Report, are available via the Internet atwww.glatfelter.com/about_us/investor_relations/sec_filings.aspx, as well as online athttp://www.proxyvoting.com/glt www.investorvote.com/GLT.

Page | ||||

Security Ownership of Certain Beneficial Owners and Management | ||||

Proposal 2: Ratification of Appointment of Deloitte & Touche LLP | ||||

Proposal 3: Approval of Amendments to the P. H. Glatfelter Company Long-Term Incentive Plan | 10 | |||

| A-1 | ||||

PROXY STATEMENT

The accompanying proxy is being solicited by the Board of Directors (the “Board”) of P. H. Glatfelter Company (“we,” “us,” or the “Company”), 96 South George Street, Suite 520, York, Pennsylvania 17401, in connection with the 20122013 Annual Meeting of Shareholders to be held on Tuesday,Thursday, May 8, 20129, 2013 at 10:9:00 a.m., at the York County Heritage Trust, Historical Society Museum, 250 East Market Street, York, Pennsylvania, 17403. This proxy statement and the accompanying proxy card are being mailed on or about March 29, 2012April 3, 2013 to shareholders of record as of March 9, 2012.15, 2013.

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will be asked to consider and act upon the following matters:

the election of nine (9) directors to serve on the Board for a one year term expiring in 2013;2014;

a proposal to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012;2013;

approval of the Company’s Amended and Restated Long-Term Incentive Plan for purposes of complying with Section 162(m) of the Internal Revenue Code, including an increase in the number of shares available to be awarded under the Plan;

advisory approval of the company’sCompany’s executive compensation and pay practices;

such other business as may properly come before the meeting.

Why are shareholders receiving these proxy materials?

Shareholders are receiving these proxy materials in connection with the solicitation of proxies by the Board of Directors for the matters to be considered at the 20122013 Annual Meeting, and, therefore, shareholders are encouraged to read this proxy statement and to vote their shares by mailing the attached proxy card, voting online or by telephone, or voting in person at the Annual Meeting. The Board has appointed directors Kathleen DahlbergNicholas DeBenedictis and Richard C. Ill,Ronald J. Naples, or either of them (the “Proxy Holders”) with power of substitution, to vote all properly executed proxies that are received from shareholders who are entitled to vote at the Annual Meeting or at any adjournment of the Annual Meeting that are received from shareholders who are entitled to vote.Meeting.

Who may vote?

Shareholders of record as of the close of business on March 9, 2012,15, 2013, the record date, may vote at the Annual Meeting. At the close of business on March 9, 2012,15, 2013, there were 42,628,95042,888,606 shares of the Company’s common stock issued and outstanding and eligible to vote at the Annual Meeting.

What is a beneficial owner?

If on March 9, 201215, 2013 a shareholder’s shares were not held in the shareholder’s name, but rather in the name of a brokerage firm, bank, dealer, or other similar organization, then the shareholder is the beneficial owner of shares and those shares are referred to as being held in “street name.” The broker, bank or firm that is holding the shareholder’s shares is the shareholder of record for purposes of voting at the Annual Meeting. As the beneficial owner of any shares held in street name, a shareholder has the right to direct the broker or other agent that is holding the shareholder’s shares how to vote those shares on those matters that will be considered at the Annual Meeting.

How does a shareholder vote?

A shareholder is entitled to one vote per share of stock owned on the record date, on each item of business presented at the Annual Meeting, except that each shareholder has cumulative voting rights with respect to electing directors. Cumulative voting means that a shareholder is entitled to as many votes in electing directors as is equal to the number of shares of common stock that are owned by the shareholder on the record date, multiplied by the number of directors to be elected. Accordingly, for the election of nine directors, a shareholder may cast that total number of votes “For,” or “Withhold” all of those votes from, a single nominee, or may distribute or withhold the total number of votes between the nine nominees as the shareholder determines, up to the number of shares of common stock that are owned by the shareholder on the record date, multiplied by nine. The persons named in the accompanying proxy card as Proxy Holders will vote the shareholder’s shares as the shareholder designates on the proxy card, including any exercise of cumulative voting rights, through the distribution of votes among the nominees as indicated on the proxy card. Absent such designation, the Proxy Holders may use their discretionary authority to vote the shareholder’s shares as the Proxy Holders shall determine including voting those shares cumulatively.

For the proposal to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012,2013, a shareholder may vote “For” or “Against” the proposalsproposal or “Abstain” from voting.

-1-

For the proposal to approve the proposed amendments to the Company’s Amended and Restated Long-Term Incentive Plan, a shareholder may vote “For” or “Against” the proposal or “Abstain” from voting.

For the advisory vote on executive compensation, commonly known as a “say-on-pay” vote, a shareholder may vote “For” or “Against” the proposal or “Abstain” from voting.

-2-

Only shareholders of the Company’s common stock on the Record Date may attend the Annual Meeting, and those shareholders attending in person will need an admission ticket or other proof of stock ownership to be admitted to the Annual Meeting.

For registered shareholders of the Company, an admission ticket is attached to their proxy card. Registered shareholders who plan to attend the Annual Meeting are requested to vote in advance of the Annual Meeting by telephone, internet or by competingcompleting and mailing in their proxy card, but should retain the admission ticket and bring it with them to the Annual Meeting if they plan to attend.

Shareholders whose shares are registered in the name of a bank, broker or other institution are referred to as “beneficial owners” of companyCompany stock. Beneficial owners should have received voting instructions or a proxy card from their broker or agent rather than from the Company. Shareholders who are beneficial owners of Company stock should follow the voting instructions provided by their broker or agent to ensure that their votes are counted.

To vote in person at the Annual Meeting, beneficial owners may obtain an admission ticket from their respective broker or agent, or may present proof at the Annual Meeting of their ownership of Company stock as of the Record Date. For example, a shareholder may bring an account statement or a letter from his/her bank or broker confirming that the shareholder owned Company common stock on the Record Date for the Annual Meeting.

How can a shareholder change his/her vote?

Shareholders of record can revoke their proxy at any time before their shares are voted if they (1) deliver a written revocation of their proxy to the Company’s Secretary; (2) submit a later dated proxy (or voting instruction form if they hold their shares in street name); or (3) vote in person at the Annual Meeting. Shareholders who are beneficial owners should follow the instructions provided by their respective broker or bank to change their vote.

What is a quorum?

As of March 9, 2012,15, 2013, there were 42,628,95042,888,606 shares of the Company’s common stock outstanding and entitled to vote. The presence of shareholders entitled to cast at least a majority of the votes that all shareholders are entitled to cast on a particular matter will constitute a

quorum for the purposes of such matter. Abstention or broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A broker “non-vote” occurs when a broker or bank holding shares for a beneficial owner does not vote on a particular matter because the broker or bank does not have discretionary voting authority to vote on the proposal and the beneficial owner has not provided voting instructions.

How does discretionary voting authority apply?

If a shareholder of record signs and returns the accompanying proxy card, but does not make any selections, the Board’s appointed Proxy Holders will have discretion to vote the shareholder’s shares on behalf of the shareholder at the Annual Meeting as recommended by the Board.

If a beneficial owner of shares does not provide the bank or broker that holds such shares with specific voting instructions, under the rules of various national and regional securities exchanges, the shareholder’s bank or broker may generally vote on routine matters but cannot vote on non-routine matters. Proposal 1 (election of directors), Proposal 3 (approval of amendments to Long-Term Incentive Plan) and Proposal 34 (advisory vote on executive compensation) are not routinenon-routine matters. The Company believes Proposal 2 (ratification of auditors) will be considered routine.

If a shareholder’s bank or broker does not receive instructions from the shareholder on how to vote his or her shares on a non-routine matter, the shareholder’s bank or broker will inform the Company that they do not have the authority to vote on this matter with respect to the beneficial owner’s shares.We encourage beneficial shareholders to provide voting instructions to the bank, broker or agent that holds their shares by carefully following the instructions in the notice provided by the shareholder’s bank, broker or agent.

What is the Board’s recommendation?

The Board recommends a vote:

FOR the election of the nine (9) nominees for director;

FOR the ratification of Deloitte & Touche LLP as the Company’s independent registered public accounting firm;

-2-

FOR the approval of the Amended and Restated Long-Term Incentive Plan including an increase in the number of shares available to be awarded under the Plan; and

FOR the approval of the Company’s compensation policies and practices, and current executive compensation as discussed in this proxy statement.

-3-

What vote is needed to elect directors and for the proposals to be adopted?

| • | Election of Directors. The nine nominees for director receiving the highest number of votes cast by shareholders will be elected to serve on the Board of Directors of the Company. Pursuant to the Company’s majority-voting policy, in an uncontested election, if a nominee for director receives a greater number of votes “withheld” than votes “for” his or her election, and no successor has been elected at the Annual Meeting, the director must promptly tender his or her resignation following certification of the shareholder vote. |

| • | Ratification of |

| • | Approval of Amendments to the Long-Term Incentive Plan. A majority of the votes entitled to be cast at the meeting, in person or by proxy, must vote “for” the approval of the proposed amendments to the Company’s Long-Term Incentive Plan for the proposal to be adopted, provided that the total votes cast on the proposal represent more than 50% of all shares entitled to vote on the proposal. |

| • | Approval of Executive Compensation. This proposal gives you, as a shareholder, the opportunity to endorse, not endorse, or take no position on our compensation program for the Named Executive |

Who pays for the proxy solicitation related to the Annual Meeting?

The Company pays the cost of preparing, printing, assembling and mailing this proxy statement and other proxy solicitation materials. The Company will also reimburse brokers and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding the proxy statement and other proxy soliciting materials to beneficial owners. In addition to the solicitation of proxies by mail, some of our directors, officers, other employees and agents may solicit proxies personally, by telephone and by other means. The officers and directors who may solicit proxies personally receive no special compensation for any solicitation activities.

Will any business other than that discussed in this proxy statement be considered or acted upon at this Annual Meeting?

No. The Company’s by-laws required shareholders to submit advance notice of all director nominations and shareholder proposals to be considered at the 20122013 Annual Meeting to the Company by November 29, 2011,2012, regardless of whether the shareholder seeks inclusion of their nomination or proposal in this proxy statement, or intends to solicit proxies on their own. Because the Company did not receive any such notice

of nominations or proposals, no other director nominations, shareholder proposals or other matters will be considered at the 20122013 Annual Meeting.

When are shareholder proposals due for inclusion in the proxy statement for the 20132014 Annual Meeting?

A proposal that a shareholder would like to present at the 20132014 Annual Meeting must be submitted to the Company’s Secretary prior to the preparation of the 20132014 proxy statement. To be included in the proxy statement for the 20132014 Annual Meeting, a shareholder proposal must be submitted in writing to the Company’s Secretary and delivered to, or mailed and received by the Company no later than November 29, 2012.2013. The Company’s by-laws prescribe the procedures a shareholder must follow to bring business before shareholder meetings. To bring matters before the 20132014 Annual Meeting, and to include a matter in the proxy statement for that meeting, a notice that includes all of the information required by the Company’s by-laws must be received by November 29, 2012.2013.

-3-

How can a shareholder nominate director candidates?

A shareholder may recommend nominees for consideration by the Board’s Nominating and Corporate Governance Committee for nomination for election to the Board. Shareholder recommendations for director nominees will receive the same consideration by the Board’s Nominating and Corporate Governance Committee that all other director nominee recommendations receive. If a shareholder wishes to recommend a nominee for director, the shareholder should submit such recommendation in writing, together with any supporting materials deemed appropriate, to the Company’s Secretary.

-4-

A shareholder may nominate a person for election to the Board, provided the recommendation is made in accordance with the procedures described herein and in the Company’s by-laws. To nominate a candidate for director at the 20132014 Annual Meeting, notice of the nomination must be in writing and delivered to, or mailed and received at, the Company, no later than November 29, 2012.2013.

What must be included in the notice to submit a shareholder proposal or to nominate a director candidate?

The notice must include:

if a shareholder is submitting a proposal, a description of the business desired to be brought before the meeting, the reasons for conducting the business at the meeting, and any material interest the shareholder has in the business;

if a shareholder is submitting a nomination for election to the Board, various matters regarding:information regarding the nominee, including name, address, occupation, shares held, and a representation by the shareholder and the nominee that there are no undisclosed voting arrangements;

the shareholder’s name and address, a description of the shares held, a description of any arrangement or agreement with other shareholders or the nominee with respect to the nomination;

a representation that the shareholder will attend the 2014 Annual Meeting and submit the proposal or nominate the nominee;

a description of any hedging arrangements that the shareholder has entered into with respect to our stock; and

a statement whether the shareholder intends to solicit, or participate in the solicitation of, proxies with respect to the proposal or nomination.

This is a general description of the notice required to submit a proposal or nomination for consideration at the 20132014 Annual Meeting. The Company’s by-laws contain a complete description of the notice requirements for shareholder proposals. Copies of the Company’s by-laws may be obtained from the Company’s website atwww.glatfelter.com/about_us/ corporate_governance/bylaws.aspx or free of charge from the Secretary.

The proposal and notice must otherwise comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

-5--4-

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

To the Company’s knowledge, the following table sets forth information regarding ownership of the Company’s outstanding common stock as of March 9, 2012,15, 2013, (except as otherwise noted) by: (i) each person who is known by the Company to own beneficially more than 5% of the common stock of the Company; (ii) each director, director nominee and Named Executive Officer; and (iii) all directors, director nominees and executive officers as a group. Except as otherwise indicated and subject to applicable community property laws, each owner has sole voting and investment powers with respect to the securities listed. The number of shares beneficially owned by each person is determined under the rules of the Securities and Exchange Commission (“SEC”) and the information is not necessarily indicative of beneficial ownership for any other purpose. Under the rules of the SEC, all shares of which a person has the right to acquire beneficial ownership within sixty (60) days are considered beneficially owned by that person.

Name of Beneficial Owner | Shares Beneficially Owned (1) | Total Number of Shares Owned (1) | % of Class | Shares Beneficially Owned (1) | Total Number of Shares Owned (1) | % of Class | ||||||||||||||||||

Dimensional Fund Advisors LP | 3,866,587 | 3,866,587 | (2) | 9.07 | % | 3,625,802 | 3,625,802 | (2) | 8.45 | % | ||||||||||||||

Janus Capital Management LLC | 3,541,028 | 3,541,028 | (3) | 8.31 | % | |||||||||||||||||||

Perkins Small Cap Value | 2,800,000 | 2,800,000 | (3) | 6.57 | % | |||||||||||||||||||

Third Avenue Management LLC | 2,555,178 | 2,555,178 | (4) | 5.99 | % | |||||||||||||||||||

BlackRock, Inc. | 2,348,382 | 2,348,382 | (5) | 5.51 | % | 3,361,819 | 3,361,819 | (3) | 7.84 | % | ||||||||||||||

The Vanguard Group, Inc. | 2,264,811 | 2,264,811 | (6) | 5.31 | % | 2,828,405 | 2,828,405 | (4) | 6.59 | % | ||||||||||||||

Piper Jaffray Companies | 2,711,970 | 2,711,970 | (5) | 6.32 | % | |||||||||||||||||||

Name of Beneficial Owner | Position | Directly Owned | Indirectly Owned | Outstanding Options to Purchase | Total Number of Shares Owned (1) | % of Class | Position | Directly Owned | Indirectly Owned | Outstanding to Purchase | Total Number of Shares Owned (1) | % of Class | ||||||||||||||||||||||||||||||||

Kathleen A. Dahlberg | Director | 20,795 | — | 7,500 | 28,295 | * | Director | 24,045 | — | 5,000 | 29,045 | * | ||||||||||||||||||||||||||||||||

Nicholas DeBenedictis | Director | 18,447 | — | 2,500 | 20,947 | * | Director | 21,697 | — | — | 21,697 | * | ||||||||||||||||||||||||||||||||

Kevin M. Fogarty | Director | — | — | — | — | * | Director | — | — | — | — | * | ||||||||||||||||||||||||||||||||

J. Robert Hall | Director | 20,795 | — | 7,500 | 28,295 | * | Director | 24,814 | — | 2,500 | 27,314 | * | ||||||||||||||||||||||||||||||||

Richard C. Ill | Director | 18,975 | — | 2,500 | 21,475 | * | Director | 22,225 | — | 2,500 | 24,725 | * | ||||||||||||||||||||||||||||||||

John P. Jacunski | Senior V. P. & CFO | 33,368 | 3,088 | (7) | — | 36,456 | * | Senior V. P. & CFO | 36,045 | 2,796 | (6) | — | 38,841 | * | ||||||||||||||||||||||||||||||

Debabrata Mukherjee | V. P. & GM, Specialty Papers Business Unit | 7,906 | 1,083 | (8) | — | 8,989 | * | V. P. & GM, Specialty Papers Business Unit | 9,075 | 1,127 | (7) | — | 10,202 | * | ||||||||||||||||||||||||||||||

Ronald J. Naples | Director | 19,969 | — | 7,500 | 27,469 | * | Director | 23,219 | — | 5,000 | 28,219 | * | ||||||||||||||||||||||||||||||||

Dante C. Parrini | Chairman of the Board & CEO | 45,488 | 7,233 | (9) | — | 52,721 | * | Chairman of the Board & CEO | 49,993 | 6,186 | (8) | — | 56,179 | * | ||||||||||||||||||||||||||||||

Martin Rapp | V. P. & GM, Composite Fibers Business Unit | 15,739 | — | — | 15,739 | * | V. P. & GM, Composite Fibers Business Unit | 16,982 | — | — | 16,982 | * | ||||||||||||||||||||||||||||||||

Richard L. Smoot | Director | 21,295 | — | 2,500 | 23,795 | * | Director | 20,125 | — | — | 20,125 | * | ||||||||||||||||||||||||||||||||

Lee C. Stewart | Director | 20,795 | — | 7,500 | 28,295 | * | Director | 24,045 | — | 2,500 | 26,545 | * | ||||||||||||||||||||||||||||||||

William T. Yanavitch II | V.P., Human Resources & Administration | 15,954 | 2,811 | (10) | — | 18,765 | * | V.P., Human Resources & Administration | 17,414 | 2,545 | (9) | — | 19,959 | * | ||||||||||||||||||||||||||||||

All directors and executive officers as a group (17 individuals) | 296,684 | 19,617 | 37,500 | 353,801 | * | 330,615 | 17,778 | 17,500 | 365,893 | * | ||||||||||||||||||||||||||||||||||

| * | Less than 1% |

| (1) | For purposes of the table, shares of common stock are considered beneficially owned by a person if such person has, or shares voting or investment power with respect to, such stock. As a result, more than one person may beneficially own the same security and, in some cases, the same shares are listed opposite more than one name in the table. The table includes, in some cases, shares beneficially held by spouses or minor children, as to which beneficial |

| ownership is disclaimed. The address of each director, director nominee and Named Executive Officer of the Company is c/o P. H. Glatfelter Company, 96 South George Street, Suite 520, York, PA 17401. |

| (2) | Pursuant to a Schedule 13G filed on February |

-6-

| 3,576,543 shares and investment authority over |

-5-

| group trusts and separate accounts to which Dimensional Fund Advisors LP serves as investment manager. Dimensional Fund Advisors LP disclaims beneficial ownership of such shares. The address of Dimensional Fund Advisors LP is Palisades West, Building One, 6300 Bee Cave Road, Austin, TX 78746. |

| (3) | Pursuant to a Schedule 13G filed |

| Pursuant to a Schedule 13G filed on February |

| Australia, Ltd. is a subsidiary of the Vanguard Group, Inc and is the beneficial owner of 2,700 of the shares reported by The Vanguard Group, Inc. The address of The Vanguard Group, Inc. is 100 Vanguard Boulevard, Malvern, PA 19355. |

| Pursuant to a Schedule 13G filed on February 14, 2013, consists of 2,711,970 shares beneficially owned, as of December 31, 2012, by Piper Jaffray Companies. Advisory Research, Inc. (“ARI”), 180 N. Stetson, Chicago, IL 60601, a wholly-owned subsidiary of Piper Jaffray Companies and an investment adviser registered under Section 203 of the Investment Advisers Act of 1940, is the beneficial owner of 2,711,970 shares of the Company’s common stock as a result of acting as investment adviser to various clients. Piper Jaffray Companies may be deemed to be the beneficial owner of these 2,711,970 shares through control of ARI. However, Piper Jaffray Companies disclaims beneficial ownership of such shares. The address of Piper Jaffray Companies is 800 Nicollet Mall Suite 800, Minneapolis, MN 55402. |

| (6) | Consists of |

| Consists of |

| Consists of |

| Consists of |

-7--6-

EQUITY COMPENSATION PLAN INFORMATION

The following table provides certain information as of December 31, 20112012 regarding the Company’s equity compensation plans.

| (a) | (b) | (c) | (a) | (b) | (c) | |||||||||||||||||||

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (1) | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (3)(4) | Number of securities (1) | Weighted-average (2) | Number of securities (3)(4) | ||||||||||||||||||

Equity compensation plans approved by security holders | 3,197,472 | $ | 12.40 | 2,202,444 | 2,991,633 | $ | 12.91 | 1,708,079 | ||||||||||||||||

Equity compensation plans not approved by security holders | — | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

| |||||||||||||||||||

Total | 3,197,472 | $ | 12.40 | 2,202,444 | 2,991,633 | $ | 12.91 | 1,708,079 | ||||||||||||||||

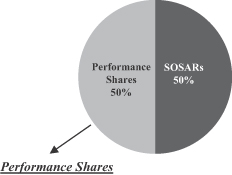

| (1) | Includes |

| (2) | Weighted average exercise price is based on outstanding non-qualified stock options and SOSAR prices only. |

| (3) | Represents the securities remaining available for issuance under the Amended and Restated Long-Term Incentive Plan. |

| (4) | Performance shares awards are paid out at between 0% and 150% of target depending on performance. For purposes of this calculation, it is assumed that Performance Share Awards will be paid at 100% of target. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who own more than ten percent (10%) of a registered class of the Company’s equity securities (“10% Holders”), to file reports of holdings and transactions in

the Company’s common stock with the SEC and the New York Stock Exchange (the “NYSE”). Based on the Company’s review of such reports (and amendments thereto), the Company believes that, in 2011,2012, its directors, executive officers and 10% Holders filed all required reports of holdings and transactions in the Company’s common stock with the SEC and the NYSE on a timely basis.

-8--7-

PROPOSAL 1: ELECTION OF DIRECTORS

At the Annual Meeting, the Company’s shareholders will vote to fill nine (9) director positions, each for one-year terms expiring on the date of the Company’s 20132014 Annual Meeting of Shareholders and until their respective successors are elected and qualified. The Board recommends that shareholders vote “For” each of the following director nominees: Kathleen A. Dahlberg, Nicholas DeBenedictis, Kevin M. Fogarty, J. Robert Hall, Richard C. Ill, Ronald J. Naples, Dante C. Parrini, Richard L. Smoot and Lee C. Stewart, each of

whom are currently serving as directors of the Company, for one-year terms expiring at the 2013 annual meeting2014 Annual Meeting of shareholdersShareholders and until their respective successors are duly elected and qualified.

The nominees have consented to serve if elected to the Board.

If a nominee is unable to serve as a director at the time of the Annual Meeting, an event that the Board does not anticipate, the Proxy Holders will vote for such substitute nominee as may be designated by the Board, unless the Board reduces the number of directors accordingly.

Board of Directors

The following table sets forth information on the director nominees. The information included in the table was obtained in part from the respective nominees and in part from the records of the Company.

| Age | Year First Elected Director | Age | Year First Elected Director | |||||||||

| PROPOSAL 1: NOMINEES TO BE ELECTED FOR TERMS EXPIRING IN 2013 | ||||||||||||

Kathleen A. Dahlberg

Ms. Dahlberg has been the Chief Executive Officer of 2Unify LLC, a private company specializing in the delivery of secure, assured and cost-effective message delivery and communications services to companies in various industries and sectors, since 2006 and a director of Theragenics Corporation since May 2008. Ms. Dahlberg has held Vice-Presidential positions with BP Amoco, Viacom International, McDonalds Corporation, Grand Metropolitan plc and American Broadcasting. Ms. Dahlberg has more than 10 years of experience as a director of public companies, and significant experience in emerging technologies, acquisitions and divestitures, consumer products and new product development, strategic planning and manufacturing. | 59 | 2001 | Kevin M. Fogarty

Mr. Fogarty has been the President and Chief Executive Officer of Kraton Performance Polymers, Inc. since 2008. He is also a director of the company and a director of its principal operating subsidiary, Kraton Polymers LLC, a leading global producer of engineered polymers and styrenic block copolymers. Mr. Fogarty previously served as Executive Vice President of Global Sales and Marketing at Kraton from 2005 to 2008. Prior to joining Kraton, Mr. Fogarty spent 14 years with the Koch Industries, Inc. family of companies, where he held a variety of roles, including as President for Polymer and Resins at Invista and President of KoSa’s Polymer & Intermediaries business. | 46 | 2012 | |||||||

Nicholas DeBenedictis

Mr. DeBenedictis has been the Chairman, Chief Executive Officer and President of Aqua America, Inc., a publicly-traded water company, since May 1993. He has also served as a director of Exelon Corporation since 2003. Prior to joining Aqua America, Mr. DeBenedictis was Senior Vice President of Corporate and Public Affairs for PECO Energy, a $4 billion nuclear utility where he was responsible for government relations, economic development and environmental policies, plus implementation of the utility’s public policy positions. Mr. DeBenedictis was President of the Greater Philadelphia Chamber of Commerce from 1986 to 1989. He also served in two cabinet positions in Pennsylvania government: Secretary of the Department of Environmental Resources and Director of the Office of Economic Development. Prior to that, Mr. DeBenedictis served in senior level positions with the U.S. Environmental Protection Agency. He has more than 18 years of experience as a director of public companies. | 66 | 1995 | J. Robert Hall

Mr. Hall has been the Chief Executive Officer of Ardale Enterprises LLC, a private company specializing in acquisition related activities in the food and consumer products industry since 1998. From September 2007 to November 2007, he also served as Chief Executive Officer of Castro Cheese Company Inc. Prior to joining Ardale, Mr. Hall spent over 20 years in the food industry holding various positions with Nabisco, Kraft and Nestle. While at Nabisco, he was President of Nabisco’s Specialty Products Company in the United States and President of Christie Brown & Company, Ltd., the maker of Nabisco cookies and crackers in Canada. Mr. Hall has also been President of Lenox Brands. Mr. Hall has more than 10 years of experience as a director of public companies and significant experience with general management, acquisitions & divestitures, marketing, sales, operations, strategic planning, new product development and research & development. | 59 | 2002 | |||||||

| Age | Year First Elected Director | Age | Year First Elected Director | |||||||||

| NOMINEES TO BE ELECTED FOR TERMS EXPIRING IN 2014 | ||||||||||||

Kathleen A. Dahlberg

Ms. Dahlberg has been the Chief Executive Officer of 2Unify LLC, a private company specializing in strategic consulting for companies in various industries and sectors, since 2006 and a director of Theragenics Corporation since May 2008. Ms. Dahlberg has held Vice-Presidential positions with BP Amoco, Viacom International, McDonalds Corporation, Grand Metropolitan plc and American Broadcasting. Ms. Dahlberg has more than 11 years of experience as a director of public companies, and significant experience in emerging technologies, acquisitions and divestitures, consumer products and new product development, strategic planning and manufacturing.

Nicholas DeBenedictis

Mr. DeBenedictis has been the Chairman, Chief Executive Officer and President of Aqua America, Inc., a publicly-traded water company, since May 1993. He has also served as a director of Exelon Corporation since 2003. Prior to joining Aqua America, Mr. DeBenedictis was Senior Vice President of Corporate and Public Affairs for PECO Energy, a $4 billion nuclear utility where he was responsible for government relations, economic development and environmental policies, plus implementation of the utility’s public policy positions. Mr. DeBenedictis was President of the Greater Philadelphia Chamber of Commerce from 1986 to 1989. He also served in two cabinet positions in Pennsylvania government: Secretary of the Department of Environmental Resources and Director of the Office of Economic Development. Prior to that, Mr. DeBenedictis served in senior level positions with the U.S. Environmental Protection Agency. He has more than 20 years of experience as a director of public companies. |

60

67 |

2001

1995 | Kevin M. Fogarty

Mr. Fogarty has been the President and Chief Executive Officer of Kraton Performance Polymers, Inc. since 2008. He is also a director of the company and a director of its principal operating subsidiary, Kraton Polymers LLC, a leading global producer of engineered polymers and styrenic block copolymers. Mr. Fogarty previously served as Executive Vice President of Global Sales and Marketing at Kraton from 2005 to 2008. Prior to joining Kraton, Mr. Fogarty spent 14 years with the Koch Industries, Inc. family of companies, where he held a variety of roles, including as President for Polymer and Resins at Invista and President of KoSa’s Polymer and Intermediaries business. Mr. Fogarty has significant experience with manufacturing, international operations, strategic planning and new product development. | 47 | 2012 | |||||||

J. Robert Hall

Mr. Hall has been the Chief Executive Officer of Ardale Enterprises LLC, a private company specializing in acquisition related activities in the food and consumer products industry since 1998. From September 2007 to November 2007, he also served as Chief Executive Officer of Castro Cheese Company Inc. Prior to joining Ardale, Mr. Hall spent over 20 years in the food industry holding various positions with Nabisco, Kraft and Nestle. While at Nabisco, he was President of Nabisco’s Specialty Products Company in the United States and President of Christie Brown & Company, Ltd., the maker of Nabisco cookies and crackers in Canada. Mr. Hall has also been President of Lenox Brands. Mr. Hall has more than 10 years of experience as a director of public companies and significant experience with general management, acquisitions and divestitures, marketing, sales, operations, strategic planning, new product development and research and development. | 60 | 2002 | ||||||||||

-9--8-

Richard C. Ill

Mr. Ill has been the Chairman and Chief Executive Officer of Triumph Group, Inc., a public, international aviation services company, since 2009. He served as President and Chief Executive Officer of Triumph from 1993 to 2009. Previously, Mr. Ill held a variety of senior executive positions with Alco Standard Corporation until he ultimately founded what is now Triumph Group. Mr. Ill has over 45 years of public company experience both in management, manufacturing and operations. Mr. Ill was recently appointed a director of Mohawk Industries, Inc., and was also a director of Airgas, Inc. from July 2004 through September 2010. Mr. Ill has 18 years of experience as a director of public companies.

Ronald J. Naples

Mr. Naples served as Chairman of the Pennsylvania Stimulus Oversight Commission and Chief Accountability Officer for the Commonwealth of Pennsylvania, having been appointed to that position by the Governor of Pennsylvania, from April 2009 until February 2011. From 1997 until May 2009, Mr. Naples was the Chairman of Quaker Chemical Corporation, a public, specialty chemical company serving the metalworking and manufacturing industries worldwide, and served as Quaker’s Chief Executive Officer from 1995 to 2008. Previously, Mr. Naples was Chairman and Chief Executive of Hunt Manufacturing Company, a public company, from 1981 to 1995. He is a former White House Fellow and served in the Ford Administration as Assistant to the Counselor to the President for Economic Affairs, and as a Special Assistant to the head of the Federal Energy Administration. Mr. Naples currently serves as a director of Glenmede Trust Company and is past Chairman of the Federal Reserve Bank of Philadelphia. Overall, Mr. Naples has over 30 years of experience as a director of public companies. | 68

66 | 2004

2000 | Richard L. Smoot

Mr. Smoot retired in 2002 from the position of Regional Chairman, PNC Bank, Philadelphia/South Jersey Markets, a position he held since 2001. From July 1991 to December 2000, Mr. Smoot served as President and Chief Executive Officer of PNC Bank in Philadelphia and Southern New Jersey, and its predecessor, Provident National Bank. He also served as Executive Vice President responsible for Operations and Data Processing for the Bank from 1987 to 1991. Before joining PNC Bank, Mr. Smoot served as First Vice President and Chief Operating Officer of the Federal Reserve Bank of Philadelphia. Mr. Smoot also serves as a director of Aqua America, Inc. and during his career has served in a variety of leadership positions for a host of governmental, for- and non-profit agencies and firms in both the public and private sector. Overall, Mr. Smoot has over 15 years of experience as a director of public companies. | 71 | 1994 | |||||||

Lee C. Stewart

Mr. Stewart is a private financial consultant with over 25 years experience as an investment banker. Previously, Mr. Stewart was a Vice President at Union Carbide Corporation from 1996 to 2001 where he was responsible for various Treasury and Finance functions, and formerly, from 2001 to 2002, was CFO of Foamex International, Inc. Mr. Stewart is also a director of AEP Industries, Inc., a NASDAQ-listed chemical company, and a director of ITC Holdings Corp. a NYSE-listed electricity transmission company. Mr. Stewart served as a director of Marsulex, Inc., a Toronto-listed chemical company, from 2000 until 2011. Overall, Mr. Stewart has over 37 years of experience as a director of public companies. | 63 | 2002 | ||||||||||

Dante C. Parrini

Mr. Parrini joined the Company in 1997, and is currently the Chairman, President and Chief Executive Officer, serving as President and Chief Executive since January 2011, and Chairman of the Board since May 2011. He previously served as Glatfelter’s Executive Vice President and Chief Operating Officer from 2005 until 2010. Prior to 2005, Mr. Parrini was Senior Vice President and General Manager, a position that he held since January 2003. Having had full global P&L responsibility in his EVP and COO capacity, Mr. Parrini has had experience leading worldwide operations, international and domestic sales, marketing, new product development, global supply chain, information technology and corporate program management. | 47 | 2010 | ||||||||||

Richard C. Ill

Mr. Ill has been the Chairman of the Board of Triumph Group, Inc., a public, international aviation services company, since 2012. Mr. Ill was the Chairman and Chief Executive Officer of Triumph Group from 2009 to 2012. He served as President and Chief Executive Officer of Triumph from 1993 to 2009. Previously, Mr. Ill held a variety of senior executive positions with Alco Standard Corporation until he ultimately founded what is now Triumph Group. Mr. Ill has over 45 years of public company experience both in management, manufacturing and operations. Mr. Ill was recently appointed a director of Mohawk Industries, Inc., and was also a director of Airgas, Inc. from July 2004 through September 2010. Mr. Ill has 18 years of experience as a director of public companies.

Ronald J. Naples

Mr. Naples served as Chairman of the Pennsylvania Stimulus Oversight Commission and Chief Accountability Officer for the Commonwealth of Pennsylvania, having been appointed to that position by the Governor of Pennsylvania, from April 2009 until February 2011. From 1997 until May 2009, Mr. Naples was the Chairman of Quaker Chemical Corporation, a public, specialty chemical company serving the metalworking and manufacturing industries worldwide, and served as Quaker’s Chief Executive Officer from 1995 to 2008. Previously, Mr. Naples was Chairman and Chief Executive of Hunt Manufacturing Company, a public company, from 1981 to 1995. He is a former White House Fellow and served in the Ford Administration as Assistant to the Counselor to the President for Economic Affairs, and as a Special Assistant to the head of the Federal Energy Administration. Mr. Naples currently serves as a director of Glenmede Trust Company and the Philadelphia Contributionship, and is past Chairman of the Federal Reserve Bank of Philadelphia. Overall, Mr. Naples has over 30 years of experience as a director of public companies. | 69

67 | 2004

2000 | Richard L. Smoot

Mr. Smoot retired in 2002 from the position of Regional Chairman, PNC Bank, Philadelphia/South Jersey Markets, a position he held since 2001. From July 1991 to December 2000, Mr. Smoot served as President and Chief Executive Officer of PNC Bank in Philadelphia and Southern New Jersey, and its predecessor, Provident National Bank. He also served as Executive Vice President responsible for Operations and Data Processing for the Bank from 1987 to 1991. Before joining PNC Bank, Mr. Smoot served as First Vice President and Chief Operating Officer of the Federal Reserve Bank of Philadelphia. During his career, Mr. Smoot has served in a variety of leadership positions for a host of governmental, for- and non-profit agencies and firms in both the public and private sector. Overall, Mr. Smoot has over 15 years of experience as a director of public companies.

Lee C. Stewart

Mr. Stewart is a private financial consultant with over 25 years experience as an investment banker. Mr. Stewart was a Vice President at Union Carbide Corporation from 1996 to 2001 where he was responsible for various Treasury and Finance functions, and formerly, from 2001 to 2002, was CFO of Foamex International, Inc. Mr. Stewart is also a director of AEP Industries, Inc., a NASDAQ-listed chemical company, and a director of ITC Holdings Corp. a NYSE-listed electricity transmission company. Mr. Stewart served as a director of Marsulex, Inc., a Toronto-listed chemical company, from 2000 until it was sold in 2011 and the company ceased to exist. Mr. Stewart has over 47 years of cumulative experience as a director of public companies. | 72

64 | 1994

2002 | |||||||

Dante C. Parrini

Mr. Parrini joined the Company in 1997 and is currently the Chairman, President and Chief Executive Officer, serving as President and Chief Executive since January 2011, and Chairman of the Board since May 2011. He previously served as Glatfelter’s Executive Vice President and Chief Operating Officer from 2005 until 2010. Prior to 2005, Mr. Parrini was Senior Vice President and General Manager, a position that he held since January 2003. Having had full global P&L responsibility in his EVP and COO capacity, Mr. Parrini has experience leading worldwide operations, international and domestic sales, marketing, new product development, global supply chain, information technology and corporate program management. Mr. Parrini has also served on the board of H. B. Fuller Company since September 2012.

| 48 | 2010 | ||||||||||

Vote Required

The nine (9) nominees for director receiving the highest number of votes cast by shareholders will be elected to serve on the Board of Directors of the Company. If you own shares through a bank, broker or other holder of record, you must instruct your bank, broker or other holder of record how to vote in order for them to vote your shares so that your vote can be counted on this proposal.

The Board believes that the election of each of the above nominees is in the best interest of the Company and its shareholders and unanimously recommends a vote FOR each nominee.

-10--9-

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF DELOITTE & TOUCHE LLP

The Audit Committee of the Board of Directors has appointed Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accounting firm for the fiscal year 2012,2013, subject to ratification by the Company’s shareholders. Deloitte audited the Company’s consolidated financial statements for the fiscal year ended December 31, 2011.2012.

A Deloitte representative is expected to attend the Annual Meeting, will be given the opportunity to make a statement if he or she chooses to do so, and will be available to respond to appropriate shareholder questions.

What did the Company pay its independent registered public accounting firm in 20112012 and 2010?2011?

For the years ended December 31, 20112012 and 2010,2011, the aggregate fees billed by Deloitte and paid by the Company to Deloitte were as follows:

| 2011 | 2010 | 2012 | 2011 | |||||||||||||

Audit Fees(1) | $ | 2,158,434 | $ | 2,426,974 | $ | 2,517,701 | $ | 2,158,434 | ||||||||

Audit Related Fees(2) | 19,257 | — | 6,429 | 19,257 | ||||||||||||

Tax Fees(3) | 244,300 | 95,000 | 215,761 | 244,300 | ||||||||||||

|

|

|

| |||||||||||||

Total Fees | $ | 2,421,991 | $ | 2,521,974 | $ | 2,739,891 | $ | 2,421,991 | ||||||||

| (1) | Audit Fees — For professional services performed by Deloitte for the audit of the Company’s annual consolidated financial statements, review of consolidated financial statements included in the Company’s Quarterly Reports on Form 10-Q, Sarbanes-Oxley Section 404 attestation services, due diligence services and services that are normally provided in connection with statutory and regulatory filings or engagements. |

| (2) | Audit-Related Fees — For assurance and related services performed by Deloitte that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements and are not reported under footnote (1) above. |

| (3) | Tax Fees — For professional services performed by Deloitte with respect to tax compliance, tax advice and tax planning. This includes tax planning and consultations; tax audit assistance; and tax work stemming from “Audit-Related” items. |

All services rendered for the Company by Deloitte in 20112012 were permissible under applicable laws and regulations, and were pre-approved by the Audit Committee. The Audit Committee’s Audit and Non-Audit Services Pre-Approval Policy (“Pre-Approval Policy”) provides for the pre-approval of audit and non-audit services performed by the Company’s independent registered public accounting firm. Under the policy,Pre-Approval Policy, the Audit Committee may pre-approve specific services, including fee levels, by the independent registered public accounting firm in a

designated category (audit, audit-related, tax services and all other services). The Audit Committee may delegate this authority in writing to one or more of its members, provided that the member or members to whom such authority is delegated must report their decisions to the Audit Committee at its next scheduled meeting.

Vote Required

The affirmative vote of a majority of the shares of the Company’s common stock present in person or represented by proxy and voting at the Annual Meeting is required for approval of this proposal. If you own shares through a bank, broker or other holder of record, you must instruct your bank, broker or other holder of record how to vote in order for them to vote your shares so that your vote can be counted on this proposal.

The Board believes that the ratification of Deloitte as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 20122013 is in the best interest of the Company and the shareholders, and unanimously recommends a vote FOR the proposal.

PROPOSAL NO. 3: APPROVE THE AMENDED AND RESTATED LONG-TERM INCENTIVE PLAN, INCLUDING AN INCREASE IN THE NUMBER OF SHARES AVAILABLE TO BE AWARDED UNDER THE PLAN

The Compensation Committee of the Company’s Board approved and recommended to the Board, and the Board adopted, subject to shareholder approval, amendments to the Company’s Amended and Restated Long-Term Incentive Plan (the “Plan”). The Board recommends that the shareholders approve the amended Plan.

The amended Plan is set forth in full atAppendix A to this proxy statement. A summary of its principal provisions of the amended Plan is set forth below. This summary does not purport to be a complete description of all the provisions on the amended Plan. It is qualified in its entirety by reference to the complete text of the amended Plan attached asAppendix A.

What changes have been made to the existing Plan?

The amended Plan includes changes to:

Increase the number of shares of common stock available for awards under the Plan by 1,030,000 shares, so that a total of 5,568,545 shares are authorized for issuance after the effective date of the amended Plan. All share limits are subject to adjustment in the event of changes in capitalization and similar changes.

-10-

Increase the limits on individual participant awards under the Plan.

Revise the share counting provisions of the Plan, so that, for example, shares surrendered in payment of the exercise price of an award or to satisfy tax withholding obligations will not be available for reissuance under the Plan.

Provide that the term of the Plan will end on the 10th anniversary of the effective date of the amended Plan.

Incorporate into the Plan the definition of change in control that has been used in grant agreements under the Plan since 2008, and describe actions the Compensation Committee may take with respect to outstanding awards in the event of a change in control.

Provide that awards will be subject to applicable clawback policies, insider trading policies, policies prohibiting pledging or hedging of shares, and other policies approved by the Board.

Make other appropriate changes.

The effective date of the amended Plan will be the date on which the shareholders approve the amended Plan, which is expected to be May 9, 2013 (referred to as the “effective date”).

What are the purposes of the Plan?

The purposes of the Plan are to reward eligible participants by awarding appropriate incentives for achieving long-range Company goals, provide incentive compensation opportunities that are competitive with those of peer companies, and further match participants’ financial interests with those of the Company’s other shareholders, thereby enhancing the long-term financial interest of the Company and its affiliates, including through the growth in the value of the Company’s equity and enhancement of long-term shareholder return. The Plan is also intended to facilitate recruitment and retention of outstanding personnel eligible to participate in the Plan.

How many shares may be issued under the Plan?

The Plan authorizes the issuance of an additional 1,030,000 shares of the Company’s common stock, subject to adjustment as described below. If our shareholders approve the Plan, the maximum aggregate number of shares available for issuance after the effective date will be 5,568,545 shares, subject to adjustment as described below. The Plan provides that 5,568,545 shares, subject to adjustment as described below, may be issued as incentive stock options under the Plan.

The 5,568,545 authorized shares represent approximately 13% of the Company’s 42,888,606 outstanding shares as of March 15, 2013, and includes 3,308,426 outstanding grants. As of March 15, 2013, 1,230,119 shares remained available for future awards under the Plan as in effect before the amendment. The Company determined the number of additional shares to be authorized based on a share value transfer model utilized by some proxy advisors. The currently available shares and the additional shares are intended to satisfy the Company’s equity award needs for approximately the next three or four years based on the Company’s recent history of stock grants, although the number of awards granted for any year could vary as the Compensation Committee deems appropriate. The Company has granted awards with respect to 513,240 shares in 2013 as of March 15, 2013 under the existing Plan. For the fiscal year ended December 31, 2012, the Company granted awards with respect to a total of 568,433 shares under the existing Plan. For the fiscal year ended December 31, 2011, the Company granted awards with respect to a total of 594,544 shares under the existing Plan.

The Plan provides that any shares covered by an award that terminates or is forfeited or cancelled, or an award that is otherwise settled without the delivery of the full number of shares underlying the award, will, to the extent of any such forfeiture, termination or cancellation, again be available for issuance under the Plan. Shares withheld for taxes or for payment of the exercise price may not be reused under the Plan, and the gross number of shares subject to a Stock Appreciation Right (“SAR”) will be counted against the share limit under the Plan. If shares are repurchased by the Company on the open market with the exercise price of options, the shares will not again be available for issuance under the Plan. Outstanding equity grants with respect to stock of an acquired company may be assumed or replaced by awards under the Plan, and such substitute awards will not reduce the Plan’s share reserve, consistent with applicable stock exchange requirements, and will not be limited by the Plan’s individual limits described below.

Who administers the Plan?

The Plan is administered by the Compensation Committee, and all acts and authority of the Compensation Committee under the Plan are subject to the provisions of its charter and such other authority as may be delegated to the Compensation Committee by the Board. Awards to non-employee directors shall be administered by the Compensation Committee consistent with a Board-approved compensation program. The Compensation Committee selects participants and, among other matters, has the exclusive power (together with the Board) to make

-11-

awards, to determine when and to whom the awards will be granted, the types of awards and number of shares covered by the awards, to establish the terms, conditions, performance criteria, restrictions and other provisions of such awards, and, subject to the terms of the Plan and applicable law, to cancel, suspend or amend existing awards.

Subject to the terms of the Plan, the Compensation Committee has the authority and discretion to determine the extent to which awards under the Plan will be structured to conform with the requirements applicable to “qualified performance-based compensation” as described in Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and to take such action, establish such procedures, and impose such restrictions as necessary to conform to such requirements. If an award under the Plan is intended to qualify as qualified performance-based compensation under Section 162(m) of the Code, and a provision of the Plan would prevent such award from so qualifying, such provision will be administered and interpreted to carry out such intention (or disregarded to the extent such provision cannot be so administered, interpreted or construed).

Except to the extent prohibited by applicable law, the Compensation Committee may allocate all or any portion of its responsibilities and powers to any of its members and may delegate all or any portion of its responsibilities to any person(s) selected by it, but the Compensation Committee cannot delegate such authority with respect to any participant who is subject to the reporting requirements of Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Compensation Committee has the power to revoke any allocation or delegation at any time.

Who is eligible for awards under the Plan?

Persons eligible to be participants under the Plan include employees, officers, non-employee directors and consultants of the Company or any subsidiary or affiliate of the Company. Eligible participants also include any individuals to whom an offer of employment or service has been extended. Holders of equity-based awards issued by a company acquired by the Company or with which the Company combines are also eligible to receive awards under the Plan, in substitution for awards granted by that company. As of March 15, 2013, there were approximately 100 salaried employees and 8 non-employee directors eligible for equity grants under the Plan.

What are the limitations on awards that may be made to any individual participant under the Plan?

The Plan imposes the following individual limits:

The maximum aggregate number of shares with respect to which options or stock appreciation rights (“SARs”) may be granted under the Plan to

any individual participant during any calendar year shall be 500,000 shares. |

The maximum aggregate number of shares with respect to which restricted stock, restricted stock units (“RSUs”), stock awards, other stock-based awards and performance awards may be granted under the Plan to any individual participant during any calendar year shall be 500,000 shares.

If performance awards are denominated in cash, the maximum aggregate cash award that may be granted under the Plan to any individual participant during any calendar year shall be $3,500,000.

The foregoing share limits are subject to adjustment as described below.

What is the term of the Plan?

No award will be granted under the Plan after the tenth anniversary of the effective date. Unless otherwise expressly provided in the Plan or in the applicable award agreement, any award granted prior to the termination date of the Plan may extend beyond such termination date, and, subject to the terms of the Plan, the Compensation Committee has the authority to administer the Plan and to amend or terminate any such award or to waive any conditions or rights under any such award beyond such date.

How is fair market value determined under the Plan?

Fair market value is the value of a share of common stock of the Company determined as follows: (i) if the shares are listed on any established stock exchange, system or market, the fair market value will be the closing price for the shares as quoted on such exchange, system or market as reported in the Wall Street Journal or such other source as the Compensation Committee deems reliable; or (ii) in the absence of an established market for the shares, the fair market value will be determined in good faith by the Compensation Committee by a reasonable valuation method, taking into account factors consistent with the requirements of Section 409A of the Code.

What types of awards are available under the Plan?

Options and SARs. The Compensation Committee is authorized to grant incentive stock options and non-qualified stock options (collectively, “options”) and SARs to participants under the Plan. The terms and conditions of each option and SAR granted will be determined by the Compensation Committee and set forth in the applicable award agreement.

The terms of any incentive stock option granted under the Plan must comply in all respects with the provisions of Section 422 of the Code. Incentive stock options may

-12-

only be granted to a participant who is an employee of the Company or a qualified subsidiary of the Company. Options designated as incentive stock options will not be eligible for treatment under the Code as “incentive stock options” (and will be deemed to be non-qualified stock options) to the extent that either (i) the aggregate fair market value of the shares (determined as of the date of grant) associated with such options that are exercisable for the first time by the participant during any calendar year (under all plans of the Company and any subsidiary) exceeds $100,000, or (ii) such options otherwise remain exercisable but are not exercised within three months after termination of employment (or such other period of time provided in Section 422 of the Code).

The term of an option or SAR may not exceed ten years from the date of grant. The exercise price of an option or SAR may not be less than the fair market value of the underlying shares on the date of grant, except with respect to outstanding equity grants with respect to stock of an acquired company that are assumed or replaced by awards under the Plan.

Subject to the terms of the Plan and the related award agreement, any option or SAR may be exercised at any time during the period commencing with either the date the option or SAR is granted or the first date permitted under a vesting schedule established by the Compensation Committee and ending with the expiration date of the option or SAR. Unless the Compensation Committee determines otherwise, if a vested option or SAR would terminate at a time when trading in Company stock is prohibited by law or by the Company’s insider trading policy, the vested option or SAR may be exercised until the 30th day after expiration of such prohibition (but not beyond the end of the term of the option or SAR).

The Compensation Committee has the discretion to determine the method of exercise of options, which may include paying the exercise price (i) in cash, (ii) by payment through a broker in accordance with procedures permitted by Regulation T of the Federal Reserve Board, (iii) by “net exercise,” which is the surrender of shares for which the option is exercisable to the Company in exchange for shares equal to the amount by which the then fair market value of the shares subject to the option exceeds the exercise, or (iv) by such other method as the Compensation Committee may approve.

The award agreement documenting an option or SAR award shall set forth the terms under which an option or SAR award may be exercised at or after separation from service.

Restricted Stock and Restricted Stock Unit Awards. The Compensation Committee may grant restricted stock or restricted stock units (“RSUs”) to participants under the Plan. The terms and conditions of each such award will be established by the Compensation Committee and set forth in an associated award agreement. The

Compensation Committee has the discretion to impose restrictions, including limitations on the right to vote shares underlying restricted stock awards or the right to receive any dividends, which restrictions may lapse separately or in combination at such times as the Compensation Committee may deem appropriate. The award agreement documenting a restricted stock award or RSU award shall set forth the terms under which restricted stock or RSUs may vest or become payable at or after separation from service.

Unless the award agreement provides otherwise, restricted stock and RSU awards (subject to satisfaction of any purchase price requirement) will be transferred or paid to the participant as soon as practicable following the award date or the termination of the vesting or lapse of restrictions set forth in the Plan or the award agreement, and the satisfaction of any and all other conditions of the award applicable to such restricted stock or RSU award.

Stock Awards and Other Stock-Based Awards. The Compensation Committee is authorized to grant stock awards to participants under the Plan. Stock awards may be granted by the Compensation Committee in addition to, or in tandem with, other awards and may be issued in lieu of any cash compensation or fees for services to the Company as the Compensation Committee, in its discretion, determines or authorizes. Stock awards will be evidenced by an agreement or in such other manner as the Compensation Committee may determine appropriate, including, without limitation, book-entry registration or issuance of stock certificates.

Subject to the terms of the Plan, the Compensation Committee may also grant to participants such other awards (including rights to dividends and dividend equivalents) that are denominated or payable in, valued in whole or in part by reference to, or otherwise based on or related to shares of the Company’s common stock as are deemed by the Compensation Committee to be consistent with the purposes of the Plan. The Compensation Committee will determine the terms and conditions of such awards and set forth such terms and conditions in an award agreement.

Unless the award agreement provides otherwise, stock awards and other stock-based awards shall be transferred or paid to the participant as soon as practicable following the award date and the satisfaction of any and all conditions of the award agreement.

Performance Awards. The Compensation Committee may grant performance awards to participants under the Plan. Performance awards may be restricted stock, RSUs, stock awards, other stock-based awards, or cash awards. The terms and conditions of each such award will be fixed by the Compensation Committee and set forth in the applicable award agreement, including the performance criteria determined by the Compensation Committee.

-13-

For performance awards intended to qualify as performance-based compensation under Section 162(m) of the Code, the performance awards shall be conditioned upon the achievement of pre-established goals relating to one or more of the following performance measures, which shall be established within 90 days after the beginning of the performance period (and before 25% of the performance period has been completed), as determined in writing by the Compensation Committee and subject to such modifications as specified by the Compensation Committee: cash flow; cash flow from operations; earnings (including earnings before interest, taxes, depreciation, and amortization or some variation thereof or earnings targets that eliminate earnings from non-core sources, such as gains from pension assets and timberland sales); earnings per share, diluted or basic; earnings per share from continuing operations; net asset turnover; inventory turnover; capital expenditures; debt, net debt, debt reduction; working capital; return on investment; return on sales; net or gross sales; market share; economic value added; cost of capital; change in assets; expense reduction levels; productivity; delivery performance; safety record; stock price; return on equity; total shareholder return; return on capital; return on assets or net assets; revenue; income or net income; operating income or net operating income; operating profit or net operating profit; gross margin, operating margin or profit margin; and completion of acquisitions, business expansion, product diversification and other non-financial operating and management performance objectives. Performance goals may be applied to either the Company as a whole or to a business unit or subsidiary entity, either individually, alternatively or in any combination, and may be measured over a period of time, including any portion of a year, annually or cumulatively over a period of years, on an absolute basis or relative to a pre-established target, to previous years’ results or to a designated comparison group, in each case as specified by the Compensation Committee.

To the extent consistent with Section 162(m) of the Code, the Compensation Committee may determine that adjustments will apply with respect to the determination of achievement of the performance goals, in such manner as may be determined by the Compensation Committee, to exclude the effect of any events that occur during a performance period, including: the impairment of tangible or intangible assets; litigation or claim judgments or settlements; the effect of changes in tax law, accounting principles or other such laws or provisions affecting reported results; accruals for reorganization and restructuring programs, including, but not limited to, reductions in force and early retirement incentives; currency fluctuations; and any extraordinary, unusual, infrequent or non-recurring items described in management’s discussion and analysis of financial condition and results of operations or the financial statements and notes to the financial statements appearing in the Company’s annual report to shareholders for the applicable year.

The Compensation Committee may, in its discretion, establish such additional restrictions or conditions that must be satisfied as a condition precedent to the payment of all or a portion of any performance award. The Compensation Committee may also reduce the amount of any performance award if it concludes that such reduction is necessary or appropriate based on: (i) an evaluation of such participant’s performance, (ii) comparisons with compensation received by other similarly situated individuals working within the Company’s industry, (iii) the Company’s financial results and conditions, or (iv) such other factors or conditions that the Compensation Committee deems relevant. In addition to establishing minimum performance goals below which no compensation will be payable pursuant to a performance award, the Compensation Committee, in its discretion, may create a performance schedule under which an amount less than or more than the target award may be paid so long as the performance goals have been achieved. Compensation Committee will not have the discretion to increase any award that is intended to be performance-based compensation under Section 162(m) of the Code.

The Compensation Committee must certify achievement of the performance goals in writing prior to payment of performance awards. Performance awards shall be transferred or paid to the participant as determined by the Compensation Committee in the applicable award agreement. The Compensation Committee may provide in the award agreement that performance awards may be payable, in whole or in part, in the event of the participant’s death or disability, a change of control or under other circumstances consistent with Section 162(m) of the Code.

Dividend Equivalents. The Compensation Committee may grant dividend equivalents in connection with awards (other than options or SARs) under such terms and conditions as the Compensation Committee deems appropriate. Dividend equivalents with respect to awards that are subject to performance conditions shall vest and be paid only if and to the extent the underlying awards vest and are paid, as determined by the Compensation Committee. Dividend equivalents may be paid to participants currently or may be deferred, consistent with Section 409A of the Code, as determined by the Compensation Committee. Dividend equivalents may be accrued as a cash obligation, or may be converted to RSUs for the participant, as determined by the Compensation Committee. Unless otherwise specified in the award agreement, deferred dividend equivalents will not accrue interest. Dividend equivalents may be payable in cash or shares or in a combination of the two, as determined by the Compensation Committee in the award agreement.

-14-

How can the number of shares available for issuance under the Plan be adjusted?

In the event that the Compensation Committee determines that any dividend or other distribution (whether in the form of cash, stock, other securities, or other property), recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, spin-off, combination, repurchase or exchange of stock or other securities of the Company, issuance of warrants or other rights to purchase stock or other securities of the Company, or other similar corporate transaction or event constitutes an equity restructuring transaction for applicable financial accounting purposes, or otherwise affects the common stock of the Company, then the Compensation Committee will adjust the following in a manner that is determined by the Compensation Committee to be appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Plan:

The number and type of shares of stock (or other securities or property) which thereafter may be made the subject of awards, including the individual limits set forth in the Plan as described above; provided, that with respect to such individual limits, an adjustment will not be made unless such adjustment can be made in a manner that satisfies the requirement of Section 162(m) of the Code.

The number and type of shares of stock (or other securities or property) subject to outstanding awards.

The grant, purchase, or exercise price with respect to any award or, if deemed appropriate, the Compensation Committee may make provision for a cash payment to the holder of an outstanding award; provided, that the number of shares subject to any award shall always be a whole number.

Other value determinations applicable to outstanding awards.

The Compensation Committee’s adjustment shall be effective and binding for all purposes of the Plan and shall be made consistent with the applicable requirements of Sections 409A and 422 of the Code.

Are awards transferable?

Except as otherwise determined by the Compensation Committee, no award and no right under any award may be assigned, sold or transferred by a participant other than by will or by the laws of descent and distribution. In making any such determination, the Compensation Committee will not authorize any assignment, sale, or other transfer that would provide a